Want it delivered daily to your inbox?

-

The recent rise in WARN notices points to an increase in the unemployment rate in June, see chart below. A WARN notice is a legal requirement for US employers to provide at least 60 days advance written notice to employees, their representatives, and government officials before conducting a mass layoff, plant closing, or relocation.

Note: The Worker Adjustment and Retraining Notification (WARN) Act helps ensure 60 to 90 days advance notice in cases of qualified plant closings and mass layoffs. WARN factor is the Cleveland Fed estimate for WARN notices: https://www.clevelandfed.org/publications/working-paper/wp-2003r-advance-layoff-notices-and-aggregate-job-loss. Sources: openICPSR, US Department of Labor, Macrobond, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

Weekly data for the number of people going to Broadway shows remains remarkably resilient, see chart below.

Sources: The Broadway League, Macrobond, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

The daily data for the top 10 airports in the US shows some weakness among foreign arrivals, see the first chart below.

However, the weakness among foreign arrivals is offset by the continued strength in travel for US citizens, and the overall TSA data for the number of passengers traveling on airplanes originating in the US remains remarkably resilient, see the second chart below.

With the trade-weighted dollar down 10% since the beginning of the year, we expect to see an increase in foreign arrivals over the summer and a decline in US citizens traveling abroad.

Note: Airports included are ATL, LAX, DFW, MIA, ORD, DEN, IAD, SFO, MCO, and JFK. Sources: CBP, Apollo Chief Economist

Sources: U.S. Department of Homeland Security, Macrobond, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

When FOMC members produce their forecasts ahead of Fed meetings, they are also asked how they view the risks to inflation and unemployment.

Currently, there are no FOMC members who foresee downside risks to the unemployment rate or inflation, see charts below.

In other words, the Fed continues to forecast stagflation and is concerned that we may experience rising inflation and rising unemployment at the same time.

These worries are likely driven by higher oil prices, tariffs, and immigration restrictions, all of which are putting upward pressure on inflation and unemployment simultaneously.

Sources: Federal Reserve Board, Bloomberg, Apollo Chief Economist

Sources: Federal Reserve Board, Bloomberg, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

In 2010, 50% of all homes sold were purchased by first-time home buyers.

Today, the share is 24%, see chart below.

Sources: National Association of Realtors, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

Examining Treasury auction metrics across the curve reveals no signs of weakness in demand for US Treasuries at present. Bid-to-cover ratios are stable, and there is no evidence of auctions systematically tailing, see the first four charts below.

These charts, however, offer little comfort when considering the rising trend in debt-to-GDP, the increasing term premium, the falling dollar, and the $9 trillion that the US government needs to refinance over the next 12 months, see the following four charts below.

In particular, debt-servicing costs are rising rapidly, and the US government currently pays a record-high $3.3 billion in interest payments every day, and for every dollar the US government collects in tax revenue, about 20 cents go to paying interest on debt.

With debt levels growing much faster than GDP, the bottom line is that Treasury issuance will continue to grow faster than the economy, and the most likely outcome is that investors will demand compensation in the form of higher long-term interest rates.

In sum, there is upside pressure on short rates from higher oil prices, higher tariffs, and restrictions on immigration, and there is upside pressure on long rates because of fiscal challenges.

This is obviously very important for investors in both public and private markets.

Our updated chart book looking at demand and supply for US Treasuries is available here.

Sources: Bureau of Public Debt, Haver Analytics, Apollo Chief Economist

Sources: US Department of Treasury, Macrobond, Apollo Chief Economist

Sources: US Department of Treasury, Macrobond, Apollo Chief Economist

Note: Bloomberg ticker USN10YTL Index. Sources: Bloomberg, Macrobond, Apollo Chief Economist

Sources: US Congressional Budget Office (CBO), Macrobond, Apollo Chief Economist

Note: The NY Fed measure for the term premium is based on a five-factor, no arbitrage structure model. Sources: Federal Reserve Bank of New York, Macrobond, Apollo Chief Economist

Note: 1-year yield differential = 1-year German government bill minus 1-year US T-bill. pp = percentage points. Sources: Bloomberg, Macrobond, Apollo Chief Economist

Sources: US Department of Treasury, Macrobond, Apollo Chief Economist

Sources: US Treasury, Bloomberg, Macrobond, Apollo Chief Economist

Sources: US Congressional Budget Office (CBO), Macrobond, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

Our outlook for real assets for the second half of 2025 is available here.

Source: MBA, Apollo Chief Economist

Source: RCA, Bloomberg, Macrobond, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

Our outlook for private equity for the second half of 2025 is available here.

Note: The calculation takes 5-year annualized and 10-year annualized returns for every 5-and 10-year window with sample starting in 2000 to 2024 and averaging returns over time. Sources: Preqin, Apollo Chief Economist See important disclaimers at the bottom of the page.

-

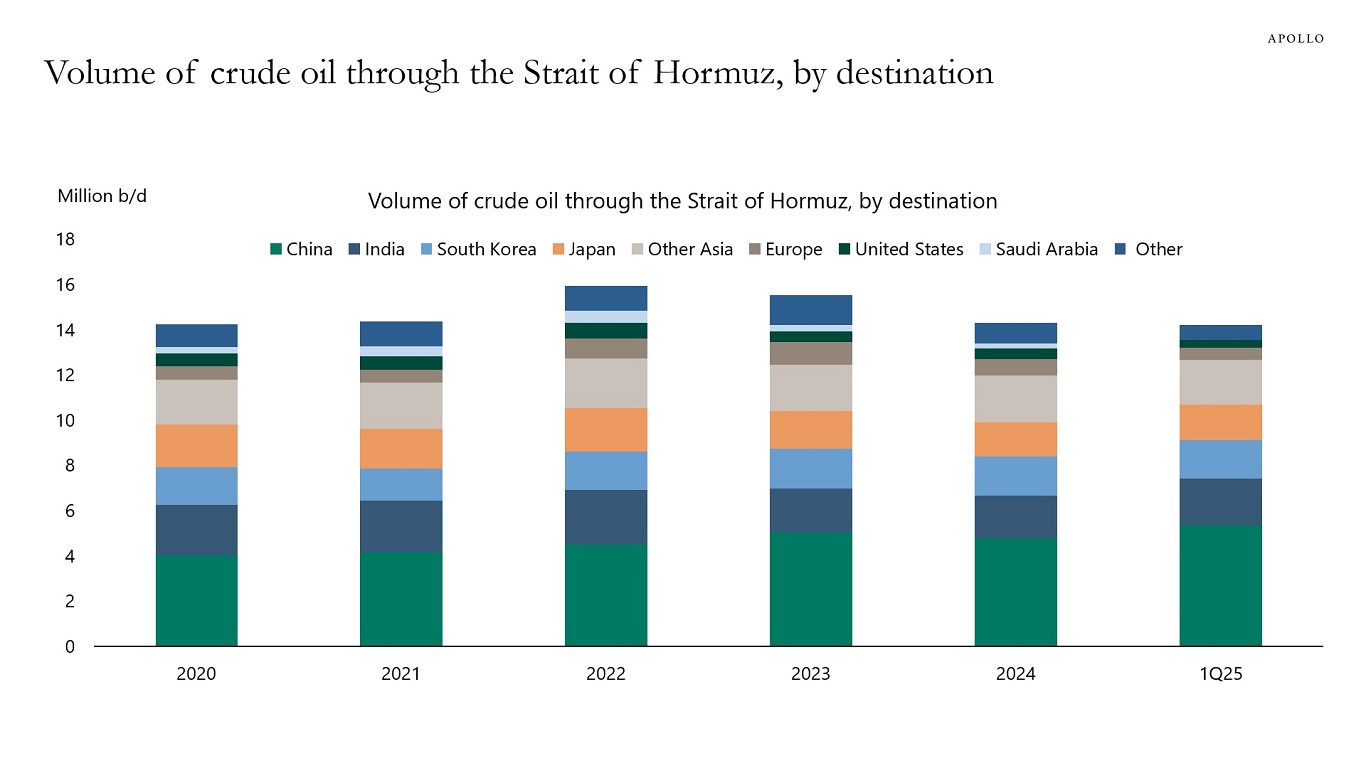

Our chart book, available here, examines energy demand and supply, as well as the significance of the Strait of Hormuz.

Source: U.S. Energy Information Administration (EIA) analysis, based on Vortexa tanker tracking and Panama Canal, Apollo Chief Economist

Source: U.S. Energy Information Administration (EIA) analysis based on Vortexa, Apollo Chief Economist

Source: U.S. Energy Information Administration (EIA) analysis based on Vortexa, Apollo Chief Economist

Source: Bloomberg, Macrobond, Apollo Chief Economist

Source: Bloomberg, Macrobond, Apollo Chief Economist

Data as of 2023. Source: U.S. Energy Information Administration (EIA) analysis based on Vortexa, Apollo Chief Economist

See important disclaimers at the bottom of the page.

-

Higher oil prices, higher tariffs, and restrictions on immigration are putting downward pressure on GDP growth and upward pressure on inflation. Lower GDP growth and higher inflation is the definition of stagflation.

The upward pressure on inflation is limiting how much the Fed can cut interest rates later this year. As a result, all-in yields will stay higher for longer, which will continue to support fixed income assets, including private credit.

We have published our consolidated views in my newest white paper, Mid-Year Outlook: At the Crossroads of Stagflation—What’s Next? You can download it here.

I will also be discussing the contents of the paper and my views in detail in an Apollo Academy class today at 11:00 ET (eligible for a CE credit). Register here. The class will be available on demand afterward.

See important disclaimers at the bottom of the page.

This presentation may not be distributed, transmitted or otherwise communicated to others in whole or in part without the express consent of Apollo Global Management, Inc. (together with its subsidiaries, “Apollo”).

Apollo makes no representation or warranty, expressed or implied, with respect to the accuracy, reasonableness, or completeness of any of the statements made during this presentation, including, but not limited to, statements obtained from third parties. Opinions, estimates and projections constitute the current judgment of the speaker as of the date indicated. They do not necessarily reflect the views and opinions of Apollo and are subject to change at any time without notice. Apollo does not have any responsibility to update this presentation to account for such changes. There can be no assurance that any trends discussed during this presentation will continue.

Statements made throughout this presentation are not intended to provide, and should not be relied upon for, accounting, legal or tax advice and do not constitute an investment recommendation or investment advice. Investors should make an independent investigation of the information discussed during this presentation, including consulting their tax, legal, accounting or other advisors about such information. Apollo does not act for you and is not responsible for providing you with the protections afforded to its clients. This presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product or service, including interest in any investment product or fund or account managed or advised by Apollo.

Certain statements made throughout this presentation may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such statements. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology.